New Dems Push Build Back Better Act as Solution to Inflation

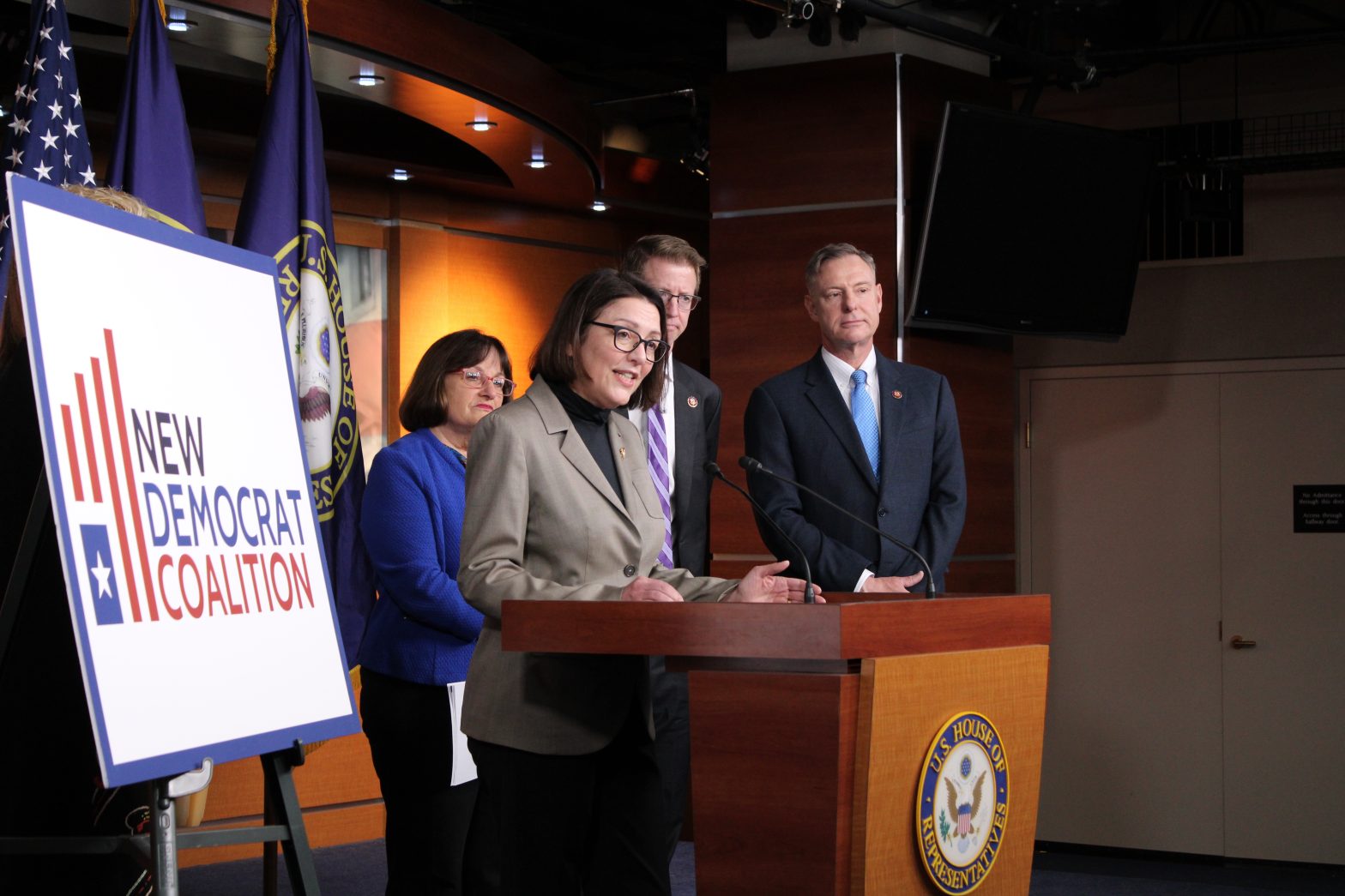

WASHINGTON — Leaders from the New Democrat Coalition and the public policy think tank Third Way participated in a press call hosted by Invest in America Action on Thursday to share their support for the Build Back Better Act’s passage.

New Dem Chair Rep. Suzan DelBene, D-Wash., was joined on the call by Reps. Brad Schneider, D-Ill., Don Beyer, D-Va., and Zach Moller, director of Third Way’s economic program, in discussing the Build Back Better Act’s economic merits and how the bill could ease long-term inflationary constraints. In addition, each of the call’s participants championed other measures included in the bill, such as its extension of the Child Tax Credit, investments to mitigate the effects of climate change and reducing the affordability threshold of the Affordable Care Act.

“Not only will this transformational legislation provide families with the middle-class tax cut, expand access to health care, fight climate change and create jobs, it will also help lower the costs that weigh the heaviest on families, from childcare to prescription drugs to housing and beyond,” DelBene said. “There’s been a lot of talk about the impact this bill will have on inflation, which is a result of several factors including obviously the impact of the pandemic, [and] decades of underinvestment in our infrastructure. And we see that this legislation could actually ease inflationary pressures by lowering costs and helping get people back to work.”

But Democrats aren’t the only ones closely examining the bill’s merits, she said. In September, a group of 17 recipients of the Nobel Memorial Prize in Economic Sciences signed an open letter in support of the Build Back Better package in which they contend the legislation will help ease long-term inflationary pressures and stimulate economic participation by improving the low employment-working age population ratio.

Because the bill invests in long-term economic capacity through supply-side measures, DelBene said it will enhance the ability of Americans to productively engage in the nation’s economy. By financing these investments through tax increases, the economists maintain in their letter the bill’s inflationary impacts will most likely be negligible and outweighed by supply-side benefits.

“We’ve already seen the economic impact of policies like Child Tax Credit—child poverty being cut in half [and] hunger has gone down,” Schneider said. “With Build Back Better, we are extending that policy and other tax cuts for working families, and we’re investing in job training and education. Importantly, as [President Joe Biden] likes to say, when I hear about investing to combat climate change I hear jobs — clean energy jobs that will decarbonize aviation and stand-up supply chains in the wind and solar industries. It means that our environmentally responsible investments are also pro-growth strategies.”

Economic advisors in the Biden administration have long maintained rising rates of inflation are a global issue related to the COVID-19 pandemic rather than a result of the administration’s spending programs. This was evidenced last week when the Organization for Economic Cooperation and Development published data that showed inflation had increased in each of its 38 member countries while oil prices quadrupled in the last 18 months as the global economy steadily rebounded from COVID-19 shutdowns.

Included in the bill’s framework is $555 billion in climate change mitigation investments — the single largest investment in our carbon-neutral energy initiatives in United States history, Schneider said. These investments entail the construction of wind turbines, the mobilization of electric grids and the expansion of the nation’s electric vehicle charging network.

“Investments in the Build Back Better Act and the bipartisan infrastructure bill will build economic resilience to help households weather economic shocks and reduce long-term inflationary pressures,” Beyer, chair of the Joint Economic Committee, said. “Just imagine what the child tax credit payments, affordable child care, and universal pre-kindergarten are going to do for the quality of our workforce in just a few years. The Build Back Better Act is going to put us in much better shape in terms of long-term economic growth.”

Measures have already been taken by the Biden administration to shore up supply chain issues in addition to the expansive investments in infrastructure. In October, Biden announced a plan to keep the Port of Los Angeles in operation around the clock to strengthen supply chain resiliency — nearly doubling the number of hours that cargo is transferred from container ships to shipping trucks each day.

The CBO projected on Thursday in its analysis of the bill that its measures would add $160 billion to the national debt over the next decade. Although the CBO found the bill would raise more than $1.2 trillion by strengthening IRS crackdowns of tax cheats, imposing higher taxes for the wealthy and other revenue increases, its provisions containing social and climate priorities would result in a net cost to the country.

The CBO’s analysis paints an incomplete picture of the bill’s budgetary focus, Moller said during the call. For instance, the CBO analysis excludes how the act can control childcare costs for working families or lower health insurance costs for many Americans.

Further, Moller asserted there’s bipartisan agreement that IRS enforcement will result in taxes being paid that are already owed.

“So bottom line—the economic benefits for working families are immense from the Build Back Better Act,” Moller said. “And between that and the bipartisan infrastructure bill, there’s substantial policy to help over the medium- and long-term supply chain issues that are driving inflation. Most of the inflation we are seeing is because we had a COVID-caused supply shock that is now working its way through the economy.”

Moller continued, “Tackling inflation will require getting more folks vaccinated and back to work, in addition to finding other ways to clear up our supply chain.”

Reece can be reached at [email protected].