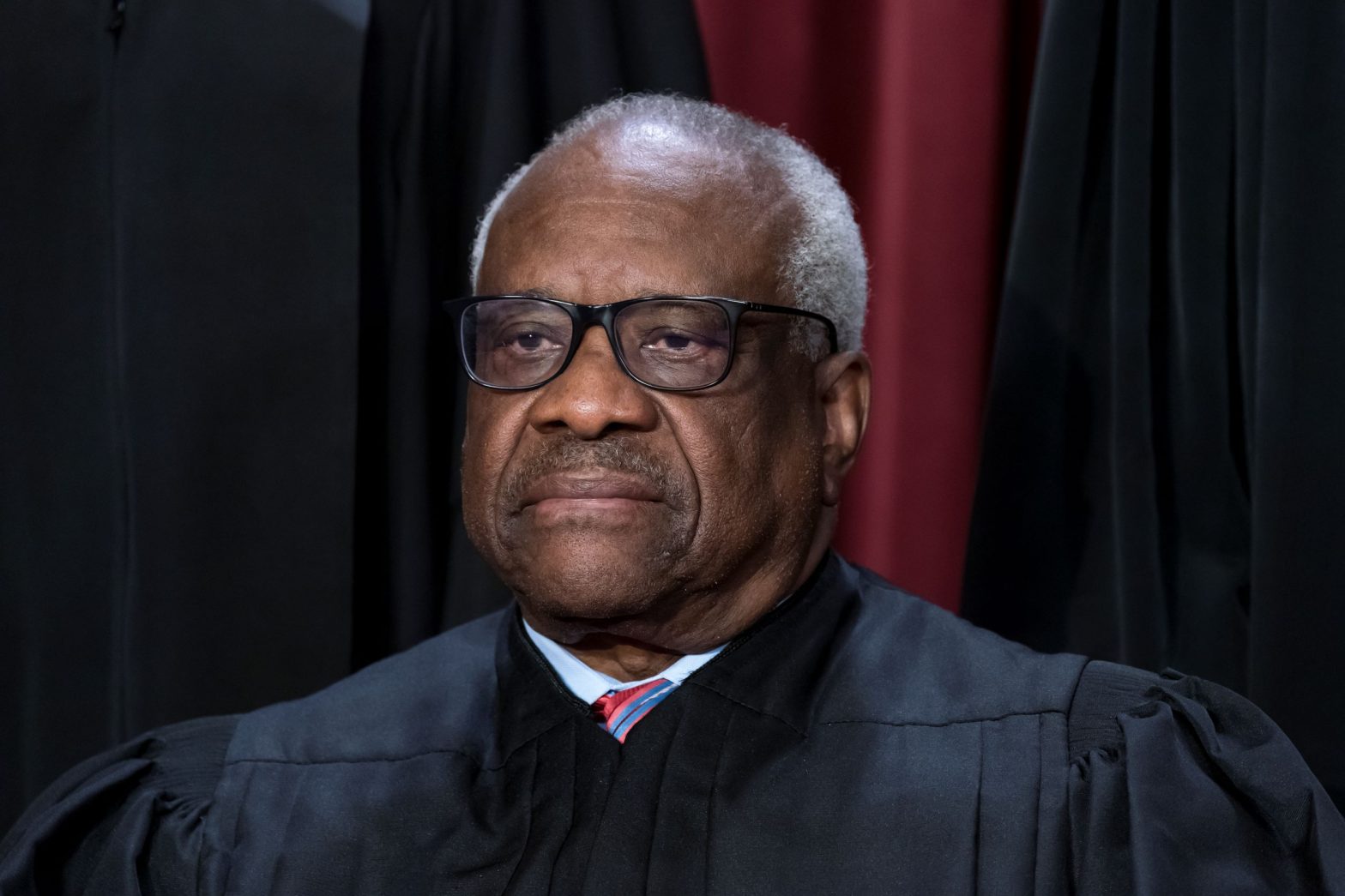

Justice Thomas Discloses Private Trips, Real Estate Transaction With Texas Billionaire

WASHINGTON — Supreme Court Justice Clarence Thomas accepted three private jet flights from Texas billionaire Harlan Crow in 2022, and the two also engaged in a real estate transaction, according to a financial disclosure report released Thursday.

Thomas filed the annual disclosure form on Aug. 9, and took the unusual step of including a defense of previous filings that came under scrutiny after ProPublica exposed his relationship with Crow, who is often described in the press as a Republican “mega donor.”

As detailed by ProPublica, Thomas and Crow have been friends for more than two decades, during which time, the justice accepted a number of gifts that were not reported.

These gifts included vacations on a superyacht, private school tuition for the great-nephew the justice was raising, and the purchase of the justice’s mother’s former home in Savannah, Georgia.

The reports fueled widespread calls for tighter Supreme Court ethics rules that continue to this day.

The nine-page disclosure notes that Thomas is an honorary member of the board of the Horatio Alger Association, an exclusive, nonprofit group, whose relationship with the justice was the subject of an extensive New York Times’ report in July.

The form also notes that Thomas received $12,000 for lecturing at the Antonin Scalia Law School at George Mason University.

But the items likely to receive the most scrutiny are the three trips Thomas took last year — two to Dallas, Texas, and one to the Adirondacks in New York — for which Crow picked up the tab.

The first trip to Dallas, which occurred in February 2022, was in order to allow Thomas to be the keynote speaker at an American Enterprise Institute conference.

Thomas notes on the form that Crow paid for his meals and for his return flight to Washington, explaining that he “flew private on the return trip due to an unexpected ice storm.”

The second trip to Dallas, in May 2022, again was so that Thomas could serve as keynote speaker at an American Enterprise Institute conference. In this case, Crow paid for the justice’s meals and his transportation both ways.

A July 2022 trip to the Adirondacks — specifically Keese Mill, New York — included Crow’s covering all transportation, meals and lodging costs.

A fourth trip listed in the disclosure form was paid for by the Hatch Center in Salt Lake City, Utah, so that Thomas could appear as the featured speaker at one of its events.

As for the Savannah real estate transaction, Thomas notes that he was including the information despite the fact the transaction fell outside the covered period of the report.

Thomas said the sale in question occurred in 2014 and included three properties in which the justice had inherited a ⅓ interest in each — his mother’s home and two additional houses on the same street.

“In 2014, Mr. Harlan Crow, a longtime friend of filer and his wife, bought all three properties for $133,000, along with other houses/lots on the same street,” Thomas wrote, adding that given he and his wife had made between $50,000 and $75,000 in capital improvements on the home, the transaction amounted to a capital loss.

Thomas said he previously disclosed his interest in two of the properties when they generated rental income for him.

“Once these properties no longer generated any rental income, filer was advised by committee staff to remove the two properties from his disclosure forms,” Thomas wrote. “However, filer inadvertently failed to realize that the ‘sales transaction’ for the final disposition of the three properties triggered a new reportable transaction in 2014, even though this sale resulted in a capital loss.”

In a detailed defense of his alleged failure to disclose past gifts, Thomas said had “adhered to the then-existing judicial regulations as his colleagues had done, both in practice and in consultation with the Judicial Conference.”

“On March 14, 2023, the Judicial Conference provided new guidance on the ‘personal hospitality’ exemption to explicitly state for the first time that ‘transportation that substitutes for commercial transportation’ will no longer be considered exempt from reporting under that provision. As a result, filer will report any such trips, beginning with this filing for calendar year 2022,” Thomas wrote.

“Prior to the March 14, 2023, guidance, filer adhered to the then-existing judicial regulations as his colleagues had done, both in practice and in consultation with the Judicial Conference, that exempted disclosing trips that were provided pursuant to the ‘personal hospitality’ exemption, as set forth in the statute and rules,” he continued.

“As far back as the 1984 Judicial Conference guidance, under the section titled, ‘Gifts of transportation, lodging, food, or entertainment,’ filers were instructed to: Exclude gifts received as the personal hospitality of any individual,” Thomas said. “The act defines ‘personal hospitality of any individual’ as ‘hospitality extended for a nonbusiness purpose by an individual, not a corporation or an organization, at the personal residence of that individual or his family or on property or facilities owned by that individual or his family.'”

Thomas goes on to say the Judicial Conference, the body charged by the Ethics in Government Act to implement disclosure laws for the judiciary, “has provided written guidance through its regulations and advice interpreting the statute that such travel need not be reported.”

In fact, he said, he is not aware of “anything in the Judicial Conference regulations issued for more than 30 years or in any advice provided by the Judicial Conference to judges that is inconsistent with this position.”

Thomas said he also based his personal disclosures in the past — or lack thereof — on advice he received from “conference staff, and in conversations with court officers and colleagues early in his tenure on the court.”

In regard to the second trip to Dallas, Thomas said he reported the flights “as advised” by the court’s administrative office.

“Because of the increased security risk following the Dobbs opinion leak, the May flights were by private plane for official travel as filer’s security detail recommended noncommercial travel whenever possible,” Thomas said.

As for the trip to the Adirondacks, Thomas said the “flights … by private plane and lodging, food, and entertainment at the Adirondacks property, were reportable under and in compliance with the new guidance and, according to advice from the staff of the Judicial Conference Financial Disclosure Committee (July 10), to be listed under ‘reimbursements’ not ‘gifts.’

“This is consistent with previous filings by other filers,” Thomas said.

Dan can be reached at [email protected] and at https://twitter.com/DanMcCue