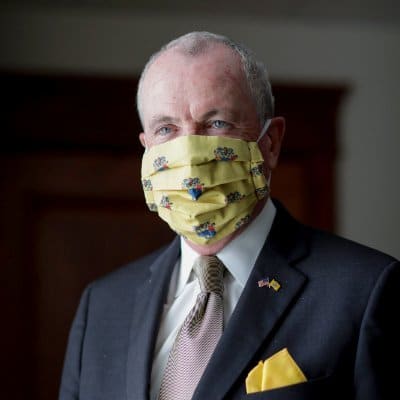

Gov. Murphy Passes $14 Billion Historic Economic Recovery Legislation

TRENTON, N.J. — Recently, New Jersey Gov. Phil Murphy passed a historic $14 billion legislation package that will benefit small businesses, local economies and more as the Garden State ushers in economic recovery and growth for years to come. The landmark New Jersey Economic Recovery Act of 2020 was passed on Thursday after being approved by both of the state’s legislatures last month.

“These programs are the product of nearly three years of hard work, during which we received input from hundreds of voices on how best to structure our state’s recovery and growth,” said Murphy of the landmark legislation.

“I am immensely proud of the result,” continued Murphy, “which will not only provide much needed relief for our small businesses, but will also fundamentally change economic development in our state while creating thousands of high-paying jobs for our residents.”

The package includes a multitude of policy-driven and tax credit programs, including the Main Street Recovery Finance Program, a $50 million program that will provide economic relief to small and micro businesses via grants, loans, loan guarantees, and technical assistance.

In addition to direct economic relief, the legislation will also create the Innovation Evergreen Fund, a first-of-its-kind program that will combine state funds with private capital to support innovative new businesses.

The IEF is expected to spur at least $250 million for the early business startup economy through competitive auctions of state tax credits. With the oversight of the New Jersey Economic Development Authority, venture capital firms will match all funds under the IEF, totaling at least $500 million in the next five years for New Jersey.

Aside from benefitting small businesses, the New Jersey Economic Recovery Act of 2020 will also promote growth for the state’s urban centers through state tax credits. Such initiatives include:

- The Brownfields Redevelopment Incentive, which will provide tax credits to developers who are redeveloping environmentally contaminated properties;

- The Historic Property Tax Credit, which will incentivize the restoration of historic properties

- The Community-Anchored Development Program, which will incentivize the construction of innovative new developments by partnering with universities, hospitals, arts, and cultural organizations and give the state an equity stake in the development.

The legislation also details reforms of two of the state’s main tax incentive programs, Emerge and Aspire, which, respectively, serve the purpose of encouraging economic development, job creation and retention, as well as encouraging the creation of redevelopment projects through tax credits.

According to Governor Murphy’s office, reforms made to the Emerge and Aspire programs will be made to, “greatly enhance compliance restrictions to ensure that money is being well spent and jobs are being created.” Murphy’s office noted that an inspector general will be appointed to investigate claims of abuses within the tax programs.

Alongside the economic benefits for businesses and industries, the bill also creates programs that address social issues that have been exacerbated in recent years. Among the noteworthy programs that are included in the bill is the Food Desert Relief program, a program that will establish and retain grocery stores in food desert communities.

The Food Desert program will not only provide tax credit incentives that will offset development costs for grocery stores in areas designated as food deserts, but the program will also provide existing food desert businesses with equipment and infrastructure to provide healthier food options for customers.

“We need a spark that is going to help our urban economies persevere through the COVID-19 pandemic and its aftermath, and there is a great deal in this legislation that can help the Capital City do just that,” said Trenton Mayor W. Reed Gusciora in a public statement.

Gusciora continued, “These incentives could help restore our revolutionary and industrial historic sites, create jobs through transformative redevelopment projects in our downtown and transit zones, and help combat widespread food insecurity, which has been made all the worse by the pandemic.”

“This incentives package will not only help strengthen our economy, but it will help address some of the longstanding inequities faced by the most distressed communities in our state,” said Lt. Gov. Sheila Oliver, who serves as commissioner of the Department of Community Affairs.

Oliver stated, “These renewed incentives are specifically directed toward reviving our local economies and helping main streets thrive throughout this crisis and beyond.

“I want to commend Governor Murphy and the legislature for their leadership in passing this bill which will put our state on a renewed path to prosperity,” concluded Oliver.