Clayton’s SEC Sets Up Cryptocurrency Firms to Fail

COMMENTARY

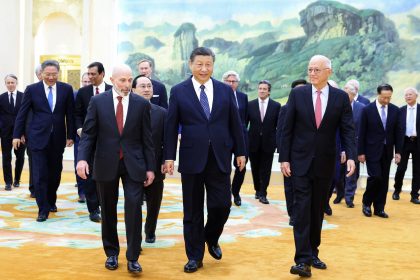

Cryptocurrency may still seem like a strange, foreign concept in many American households – but the technology has reached the point where it is entering the everyday economy. The price of Bitcoin has hit a record-high, G7 officials are pushing for digital currency regulation, and China is progressing with its own central bank digital currency, the digital yuan. The severe disruptions of 2020 have only fed the demand for simpler, faster, cheaper digital processes that can bring prosperity back to the world. The U.S. and its unrivaled innovation prowess should be leading the way. But thanks to regulators like the Securities and Exchange Commission (SEC), we’re falling behind. President-elect Joe Biden reportedly is close to nominating a new SEC Chairman, who will need to be confirmed by the Senate Banking Committee. January presents a bi-partisan opportunity to foster a government policy toward cryptocurrency that favors broader applications of the underlying technologies.

January presents a bi-partisan opportunity to foster a government policy toward cryptocurrency that favors broader applications of the underlying technologies.

Blockchain technology not only serves as a platform for cryptocurrencies and payment systems, but digital tokens are being adapted to speed up essential processes from the healthcare sector to commercial supply chains. A U.S. industry of product developers has sprung up to deliver these revolutionary solutions to businesses and consumers alike, and digital tokens now have many different uses apart from being traded like Bitcoin. Yet, the SEC under outgoing Chairman Jay Clayton decided it had the right to assert its regulatory power over any digital token no matter what it’s designed for, throwing sand in the wheels of innovation.

In July 2017, Clayton started laying the groundwork for imposing his agency’s power over digital tokens with an investigative report that found a decentralized organization that issued a coin had violated securities laws. At the time, the SEC took no enforcement action, but in December 2017, Clayton issued a statement making it clear he saw the SEC having total power over all forms of digital tokens on any blockchain, no matter what they are used for. He cited statutes adopted in the 1930s that bear little to no relation to decentralized processes for cross-border payments, global delivery services or smart contracts. The message was direct: if you design it, I’m going to regulate it.

Congress did little to either restrain Clayton’s agency or clarify the regulatory void around this emerging technology. In 2019, the Senate Banking Committee held a hearing entitled “Examining Regulatory Frameworks for Digital Currencies and Blockchain” that only gave voice to a growing list of federal agencies, from the Internal Revenue Service to the Commodities Futures Trading Commission, that can’t wait to sink their regulatory claws into the space. That same year, the SEC published a “Framework for ‘Investment Contract’ Analysis of Digital Assets” that struggled to argue a minimal use case for different kinds of tokens. But Clayton slapped a disclaimer on it that made it worthless: “This framework represents Staff views and is not a rule, regulation, or statement of the Commission. The Commission has neither approved nor disapproved its content.”

Policy experts quickly caught onto Clayton’s antics. In an op-ed for RealClearPolicy, J.W. Verret of the Mercatus Center called out the SEC for taking “an aggressive stance in widening the scope” of its authority “as much as it could get away with.” He rapped the agency’s “obtuse interpretation of this nearly century-old [legal framework]” in order to “capture as many crypto-based products as possible, and will allow the agency to pick winners and losers with no real clarity or consistency.” It was a snapshot of the queasy roller coaster ride the SEC has taken the crypto industry on.

Entering his final year as SEC Chair, Clayton insisted he’d taken “a measured, yet proactive regulatory approach” on cryptocurrencies “that both fosters innovation and capital formation while protecting our investors and our markets.” The results of his tenure, however, showed no “proactive” approach at all, with an avid hunger to regulate the industry out of the global race for leadership.

Now, around a year later, Clayton has announced he would leave the SEC by the end of 2020. The Commission report on his tenure boasts of his having “brought 56 cases involving Initial Coin Offerings (ICOs), blockchain or distributed ledger technology (DLT) and/or digital assets” since that first one in July 2017. No reference was made to supporting legitimate applications of the technology to the U.S. economy or working towards greater regulatory clarity that might free some facets of this technology from the agency’s grip.

The result has been to stifle the best innovators in the world and heap added risk on their endeavors. It has also held back corporate partners from a range of industries eager to find new efficiencies to help rebound from a dismal, devastating year on the global front. It hasn’t restrained China, however, in paving the way for its digital yuan debut in October 2020 and spur on wide-scale experimentation on how to apply the technology throughout its domestic economy. If anything, Clayton’s SEC has made their efforts bolder and drawn greater attention. There’s still time to reverse course. Although their strategies may differ, recent reports indicate that Biden is as concerned about China’s attempts at technological supremacy as the Trump administration. A new direction in cryptocurrency and blockchain regulation will assure the U.S. stays at the forefront of their development and prevent a damaging legacy from Jay Clayton and his agency.

—

Steven Titch is an independent policy analyst focusing on telecommunications, internet and information technology. He is a policy advisor to The Heartland Institute and a former policy analyst at the Reason Foundation. He has written policy papers for the Competitive Enterprise Institute and the R Street Institute. Policy areas include cybersecurity, network neutrality, municipal broadband and online gambling. His columns have appeared in Investor’s Business Daily, the Washington Examiner and the Houston Chronicle.