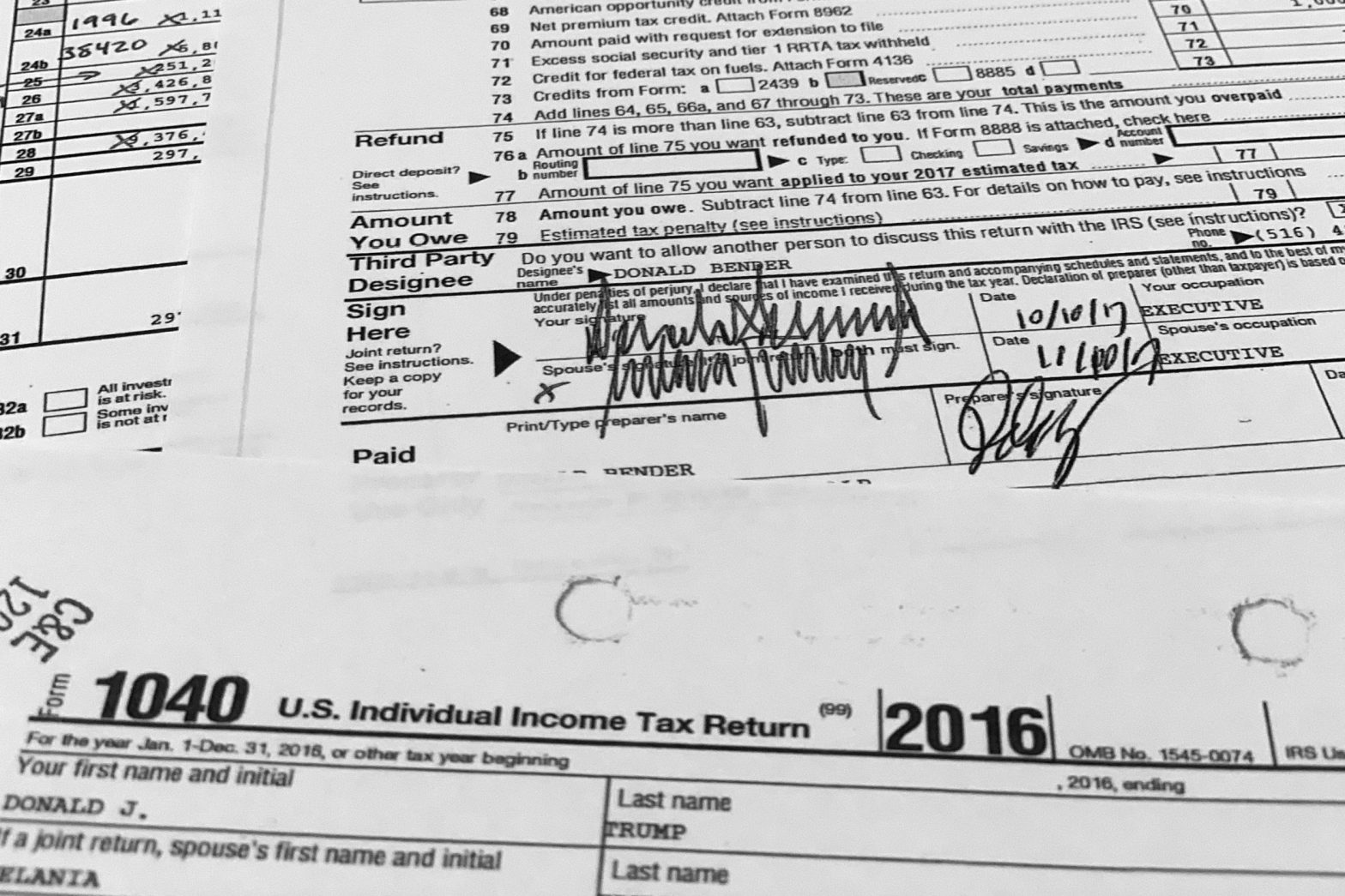

House Democrats Release Six Years of Trump Tax Returns

WASHINGTON — Democrats on the House Ways and Means Committee released six years of former President Donald Trump’s tax records on Friday, the final chapter in a years-long legal battle during which the former real estate developer and reality TV star tried to shield his finances from public scrutiny.

The release follows the publication of two reports from the committee stemming from its inquiry into the Internal Revenue Service’s practice of conducting mandatory audits on presidents while they are in office.

Those reporters found the Internal Revenue Service failed to audit Trump during the first two years of his presidency, and did not begin to do so until 2019, by which time Democrats on the Ways and Means Committee had begun proceedings to gain access to the tax records.

“A president is no ordinary taxpayer,” said Rep. Richard Neal, D-Mass., the chairman of the Ways and Means Committee, in a written statement released Friday morning. “They hold power and influence unlike any other American. And with great power comes even greater responsibility.

“We are only here today because four years ago, our request to learn more about the program under 6103 was denied. This was the first time that this key oversight function was hampered, and our committee’s jurisdiction was challenged,” Neal said.

The committee chairman went on to say that when it began its work, the panel expected to find that the IRS had been carrying out the mandatory audits as per longstanding policy, but instead discovered the program was “dormant.”

Neal said the committee also anticipated the IRS would expand its mandatory audit program to account for the complex nature of Trump’s finances “yet found no evidence of that.”

“This is a major failure of the IRS under the prior administration, and certainly not what we had hoped to find,” he said.

“But the evidence is clear. Congress must step in. I’ve proposed legislation to put the program above reproach. Ensuring IRS conducts yearly, timely examinations while publicly disclosing certain information,” Neal continued. “Our work has always been to ensure our tax laws are administered fairly and without preference, because at times, even the power of a president can loom too large.”

Much of the information contained in the tax documents released Friday is already known, much of it being contained in two committee reports released last week.

They can be viewed here and here.

Those reports show Trump paid about $1.1 million in federal income taxes during the first three years of his presidency, but none in 2020 as his income took a nosedive and his businesses bled money.

During his first year as president, Trump paid just $740 in income taxes and reported $12.9 million in losses.

According to the nonpartisan Joint Committee on Taxation, which reviewed Trump’s tax returns for the committee, a number of transactions noted in the tax documents warranted further investigation.

These included transactions between Trump and his children.

Each year, apparently, Trump received tens of thousands of dollars in interest income from three of his adult children — Don Jr., Eric and Ivanka — purportedly stemming from loans made to them.

The JCT questioned whether these “loans” were actually gifts, and whether Trump has reported them the way he did to avoid paying gift taxes while his children wrote off the interest payments on their taxes.

The committee also questioned whether Trump had deducted personal expenses as business expenses, including more than $70,000 he paid to have his hair styled during the run of “The Apprentice.”

The Ways and Means report also notes that once it resumed its mandatory audits, the IRS looked into whether Trump correctly deducted $21 million he paid to settle a series of fraud claims against the now-defunct Trump University.

The outcome of that inquiry is not known.

Dan can be reached at [email protected] and at https://twitter.com/DanMcCue