Democrats Say Corporate Tax Rate Favors the Rich, Overlooks the Poor

WASHINGTON – Congressional Democrats assailed the Trump administration’s 2017 corporate tax cut during a hearing Tuesday.

They said the drop from 35 percent to 21 percent is adding to the national deficit while leaving less tax revenue for programs to help the underprivileged.

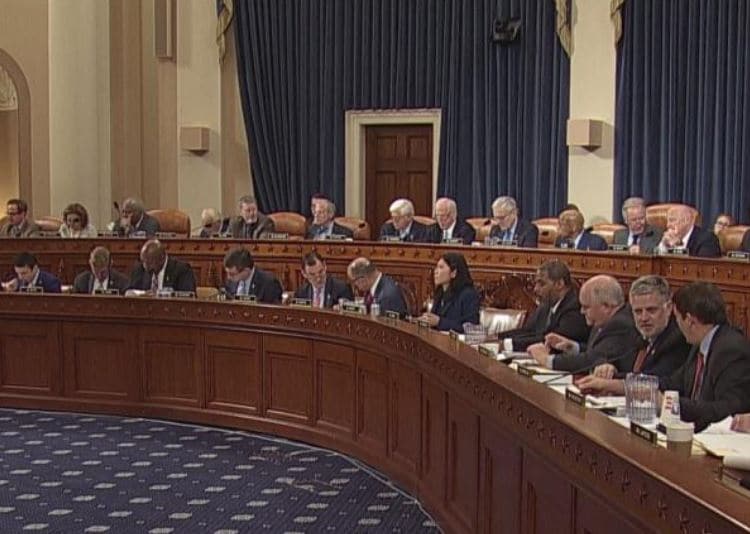

The House Ways and Means Committee held the hearing on the same day the Trump administration released its $4.8 trillion budget for fiscal 2021. It proposes further cuts to domestic spending and additional tax cuts.

Democrats are calling it dead on arrival, particularly in an election year when the president’s opposing candidates are criticizing what they say is his favoritism toward corporations and the wealthy.

Pete Buttigieg, Bernie Sanders and Elizabeth Warren all want a return to the 35 percent rate. Joe Biden says it should be 28 percent.

Similar criticism continued during the congressional hearing.

Rep. Richard Neal, chairman of the Ways and Means Committee, said, “The benefits clearly went to people at the very top” income levels.

He called the tax cut “irresponsible” and said it was “giving many corporations a windfall.”

President Trump said when he proposed the tax cut that the benefits for corporations would create new jobs and increase wages for even lower-income workers. He said it could result in as much as $4,000 in extra annual income for many households.

“Workers continue to wait for what they were promised,” said Neal, a Massachusetts Democrat.

Trump also suggested the tax cuts would pay for themselves through new economic activity.

Neal disagreed, saying, “Nor did it raise families’ incomes by $4,000 nor did it pay for itself.”

Republicans accused Democrats of exaggerating any problems from the corporate tax cut.

Rep. Kevin Brady of Texas, the ranking Republican on the Ways and Means Committee, said, “We redesigned the code so that our businesses could compete anywhere in the world.”

Corporations’ new economic activity means they are earning more money, thereby paying more taxes, according to the Republicans.

“Corporate taxes aren’t disappearing, they’re growing,” Beal said.

In some cases, the benefits exceeded expectations, he said.

“Job growth is 3.2 million greater than expected,” he said.

The dispute continued among witnesses at the congressional hearing.

Jason Furman, a Harvard University economics professor and former chair of the Council of Economic Advisers during the Obama administration, said U.S. corporate tax revenue as a percentage of gross domestic product is lower than any of 30 developed countries, except for Latvia.

Any corporate tax revenue growth predicted in the coming years will disappear long-term if the 2017 corporate tax cut becomes permanent, Furman said.

However, former Congressional Budget Office director Douglas Holtz-Eakin said the tax cut has largely halted the trend of corporations to relocate their headquarters overseas to avoid the previous 35 percent U.S. corporate tax.

Before the tax cut, corporate tax collections already were falling because of declining profits for the companies, Holtz-Eakin said. Now, other countries are lowering their corporate taxes to stay competitive with the United States.

“It got us in the middle of the pack and the pack’s still heading south,” he said.