Senate Heads to Final Vote on Semiconductor Subsidies

WASHINGTON — The Senate voted Tuesday to advance a $52 billion bill that would subsidize and provide incentives for computer chip production in the United States.

The procedural vote to end debate on the CHIPS Act means a final vote in the Senate is likely as soon as Tuesday or Wednesday. Democrats and 15 Republicans already have said they would vote to approve it.

The House approved it last week by a margin of 267 to 157.

The Creating Helpful Incentives for the Production of Semiconductors for America Act represents an attempt to play catch-up to foreign competitors, mostly in China and Taiwan.

The U.S. market share for production of the chips, also known as semiconductors, has fallen from 37% in 1990 to 12% now.

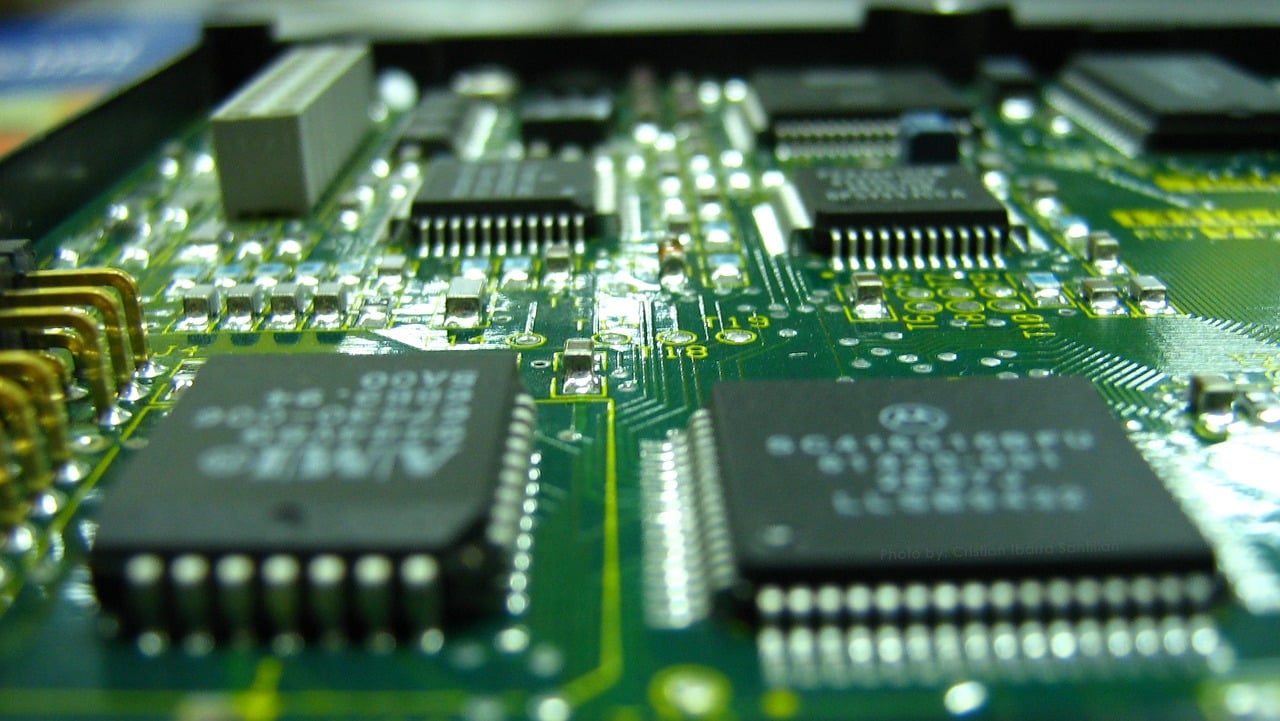

Semiconductors are crucial components for many electronic products, such as automobiles, computers, cellphones and key military equipment.

Interruptions in supply lines caused by the COVID-19 pandemic revealed the U.S. dependence on foreign manufacturers. Many industry and political leaders said the shortage undermined the U.S. economy and defense capability.

The U.S. automobile industry estimated its production fell about 1.5 million vehicles below their plans because of the semiconductor shortage. Apple Inc. also reported lost sales on its cellphones.

The CHIPS Act allocates $39 billion for manufacturers to build plants in the United States. It offers another $11.2 billion research and development to improve semiconductors.

It also would give a 25% tax credit to investors in semiconductor manufacturing.

Major semiconductor manufacturers like Intel Corp. and Micron Technology Inc. have said they will move their plants offshore if Congress does not pass the CHIPS Act.

David Loftus, president of the Electronic Components Industries Association, called the CHIPS Act “a step in the right direction.”

Advantages of the bill over current market conditions are “tax holidays and the opportunity for financial incentives to be able to locate U.S. manufacturing plants on U.S. soil,” Loftus told The Well News.

He cautioned the incentives still would face tough competition from abroad, where some foreign governments “offer much more attractive incentives” that can include direct payments to the manufacturers and workforce training.

“That’s what’s causing offshoring,” Loftus said.

Companies can apply for grants as high as $3 billion under the CHIPS Act, which is one of the issues that raised alarms among its critics.

Former U.S. Labor Secretary Robert Reich has said in media interviews there is no guarantee major corporations would use the money to boost U.S. semiconductor production. Their first loyalty lies with their shareholders, which means the grants could be diverted to other enterprises that return a faster profit, he said.

Some Republicans, like Senate Minority Leader Mitch McConnell, have said the CHIPS Act could contribute to already high inflation rates if it is included in a broader Democratic technology development stimulus package valued at $280 billion.

The bill’s opponents made a last push Monday to block it while the manufacturing industry continued with a multimillion dollar media blitz to promote it.

“A vote for the CHIPS Act funding is a vote for a stronger, more competitive manufacturing industry in America,” National Association of Manufacturers President Jay Timmons said in a statement. “But if Congress fails to pass this investment in the coming days, they will hand other countries a competitive advantage and weaken our own economy at a precarious moment.”

The Biden administration, which supports the CHIPS Act, is urging Congress to finish work on it before the August recess.

President Joe Biden met with business and labor leaders virtually Monday afternoon to discuss American competitiveness. He said the CHIPS Act would create new jobs while strengthening national security by making the United States less dependent on China’s semiconductors.

Tom can be reached at [email protected] or on Twitter at @tramstack.