Democrats Unveil Billionaires’ Tax as Biden Plan Takes Shape

WASHINGTON (AP) — Pushing past skeptics, Senate Democrats on Wednesday unveiled a new billionaires’ tax proposal, an entirely new entry in the tax code designed to help pay for President Joe Biden’s sweeping domestic policy package and edge his party closer to an overall agreement.

The proposed tax would hit the gains of those with more than $1 billion in assets or incomes of more than $100 million a year, and it could begin to shore up the big social services and climate change plan Biden is racing to finish before departing this week for global summits.

The new billionaires’ proposal, coupled with a new 15% corporate minimum tax, would provide alternative revenue sources that Biden needs to win over one key Democrat, Sen. Kyrsten Sinema of Arizona, who had rejected the party’s earlier idea of reversing the Trump-era tax breaks on corporations and the wealthy to raise revenue.

Biden met late Tuesday evening with Sinema and another Democratic holdout, Sen. Joe Manchin of West Virginia, at the White House.

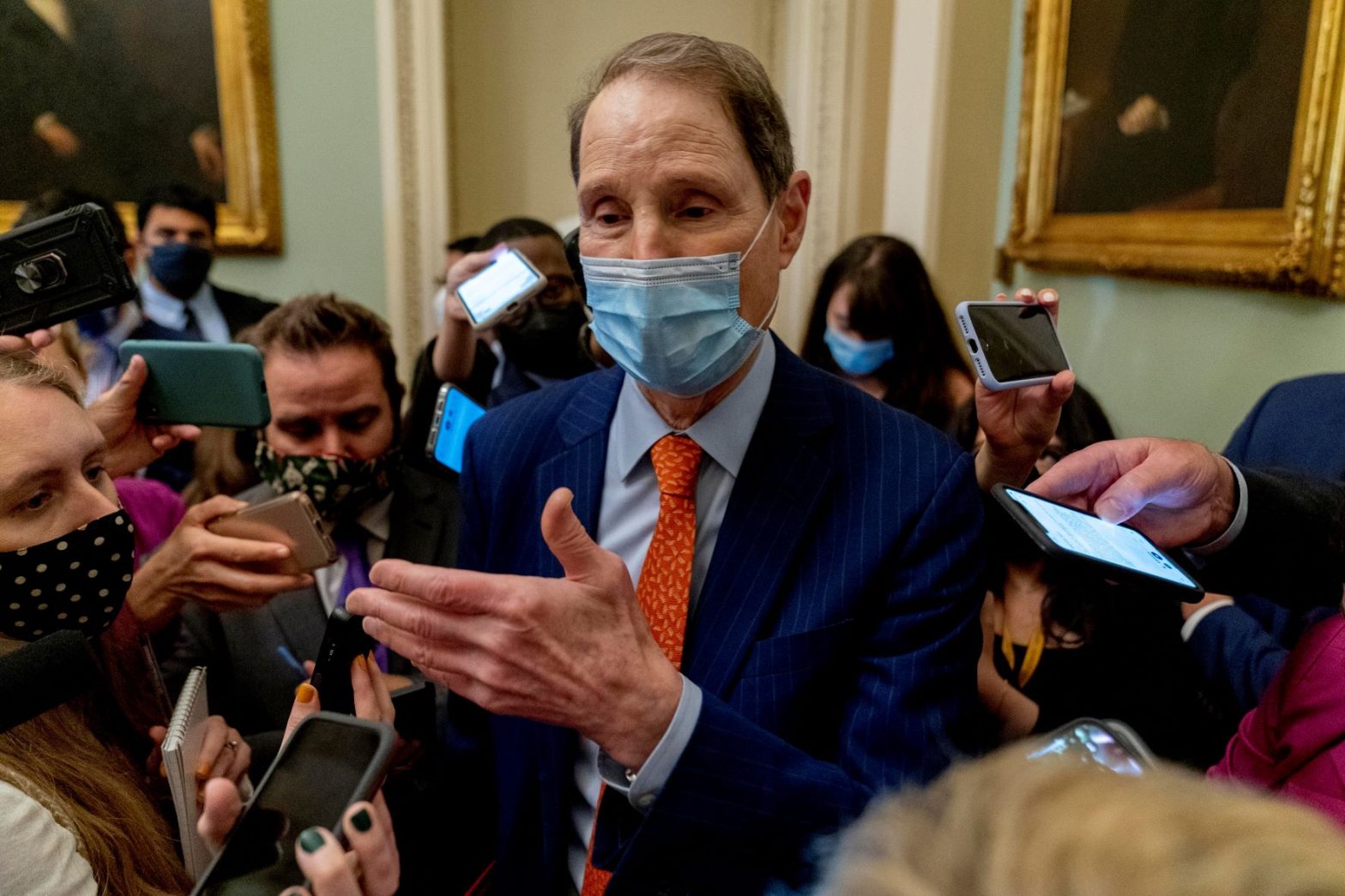

“No senator wants to stand up and say, ‘Gee, I think it’s just fine for billionaires to pay little or no taxes for years on end,'” said Democratic Sen. Ron Wyden of Oregon, chairman of the Senate Finance Committee, helming the new effort.

Biden and his party are zeroing in on at least $1.75 trillion in health care, child care and climate change programs, scaling back what had been a $3.5 trillion plan, as they try to wrap up negotiations this week.

Taken together, the new tax on billionaires and the 15% corporate minimum tax are designed to fulfill Biden’s desire for the wealthy and big business to pay their “fair share.” They also fit his promise that no new taxes hit those earning less than $400,000 a year, or $450,000 for couples. Biden insists all the new spending will be fully paid for and not piled onto the national debt.

While the new tax proposals have appeared agreeable to Manchin and could win over Sinema, whose support is needed in the 50-50 split Senate where Biden has no votes to spare, the idea of the billionaires’ tax has run into criticism from other Democrats as cumbersome or worse.

Rep. Richard Neal, D-Mass., the chairman of the Ways and Means Committee, said he told Wyden the billionaires’ tax may be more difficult to implement than the route his panel took in simply raising rates on corporations and the wealthy.

Under Wyden’s emerging plan, the billionaires’ tax would hit the wealthiest of Americans, fewer than 800 people, starting in the 2022 tax year.

It would require those with assets of more than $1 billion, or three consecutive years of income of $100 million, to pay taxes on the gains of stocks and other tradeable assets, rather than waiting until holdings are sold.

A similar billionaires’ tax would be applied to non-tradeable assets, including real estate, but it would be deferred with the tax not assessed until the asset was sold, though interest would have to be paid.

Overall, the billionaires’ tax rate would align with the capital gains rate, now 23.8%. Democrats have said it could raise $200 billion in revenue that could help fund Biden’s package over 10 years.

“I’ve been talking about this for years,” said Sen. Elizabeth Warren, D-Mass., who campaigned for the presidency on a wealth tax, and backs Wyden’s approach. “I’ve even made billionaires cry over this.”

Republicans have derided the billionaires’ tax as “harebrained,” and some have suggested it would face a legal challenge.

And key fellow Democrats were also raising concerns about the billionaires’ tax, saying the idea of simply undoing the 2017 tax cuts by hiking top rates was more straightforward and transparent.

Under the House bill approved by Neal’s panel, the top individual income tax rate would rise from 37% to 39.6%, on those earning more than $400,000 a year, or $450,000 for couples. The corporate rate would increase from 21% to 26.5%. The bill also proposes a 3% surtax on the wealthiest Americans with adjusted income beyond $5 million a year.

With Sinema rejecting the House’s approach to taxes and Manchin panning the new spending on programs, the senators have packed a one-two punch, throwing Biden’s overall plan into flux.

That was also forcing difficult reductions, if not the outright elimination, of policy priorities — from paid family leave to child care to dental, vision and hearing aid benefits for seniors.

The once hefty climate change strategies are losing some punch, too, focusing away from punitive measures on polluters that raised objections from coal-state Manchin, in a shift toward instead rewarding clean energy incentives.

Manchin’s resistance may scuttle one other tax idea — a plan to give the IRS more resources to go after tax scofflaws. He said he told Biden during their weekend meeting at the president’s home in Delaware that that plan was “messed up” and would allow the government to monitor bank accounts.

All told, Biden’s package remains a substantial undertaking — and could still top $2 trillion in perhaps the largest effort of its kind from Congress in decades. But it’s far slimmer than the president and his party first envisioned.

House Speaker Nancy Pelosi told lawmakers in a closed meeting Tuesday they were on the verge of “something major, transformative, historic and bigger than anything else” ever attempted in Congress, according to another person who insisted on anonymity to share her private remarks to the caucus.

Other leading Democrats began to lend their backing to the emerging deal.

“We know that we are close,” said Rep. Joyce Beatty, D-Ohio, the chair of the Congressional Black Caucus, after a meeting with Biden at the White House. “And let me be explicitly clear: Our footprints and fingerprints are on this.”

From the White House, press secretary Jen Psaki said Biden still hoped to have a deal in hand to show foreign leaders the U.S. government was performing effectively on climate change and other major issues. But she acknowledged that might not happen, forcing him to keep working on the package from afar.

She warned about failure as opposed to compromise.

“The alternative to what is being negotiated is not the original package,” she said. “It is nothing.”

Democrats are hoping to reach an agreement by week’s end, paving the way for a House vote on a related $1 trillion bipartisan infrastructure bill before routine transportation funds expire Sunday. That separate roads-and-bridges bill stalled when progressive lawmakers refused to support it until deliberations on the broader Biden bill were complete.

___

Associated Press writers Farnoush Amiri, Darlene Superville and Colleen Long contributed to this report.