Bill to Modify State Tax Deduction Splits Opinions During House Hearing

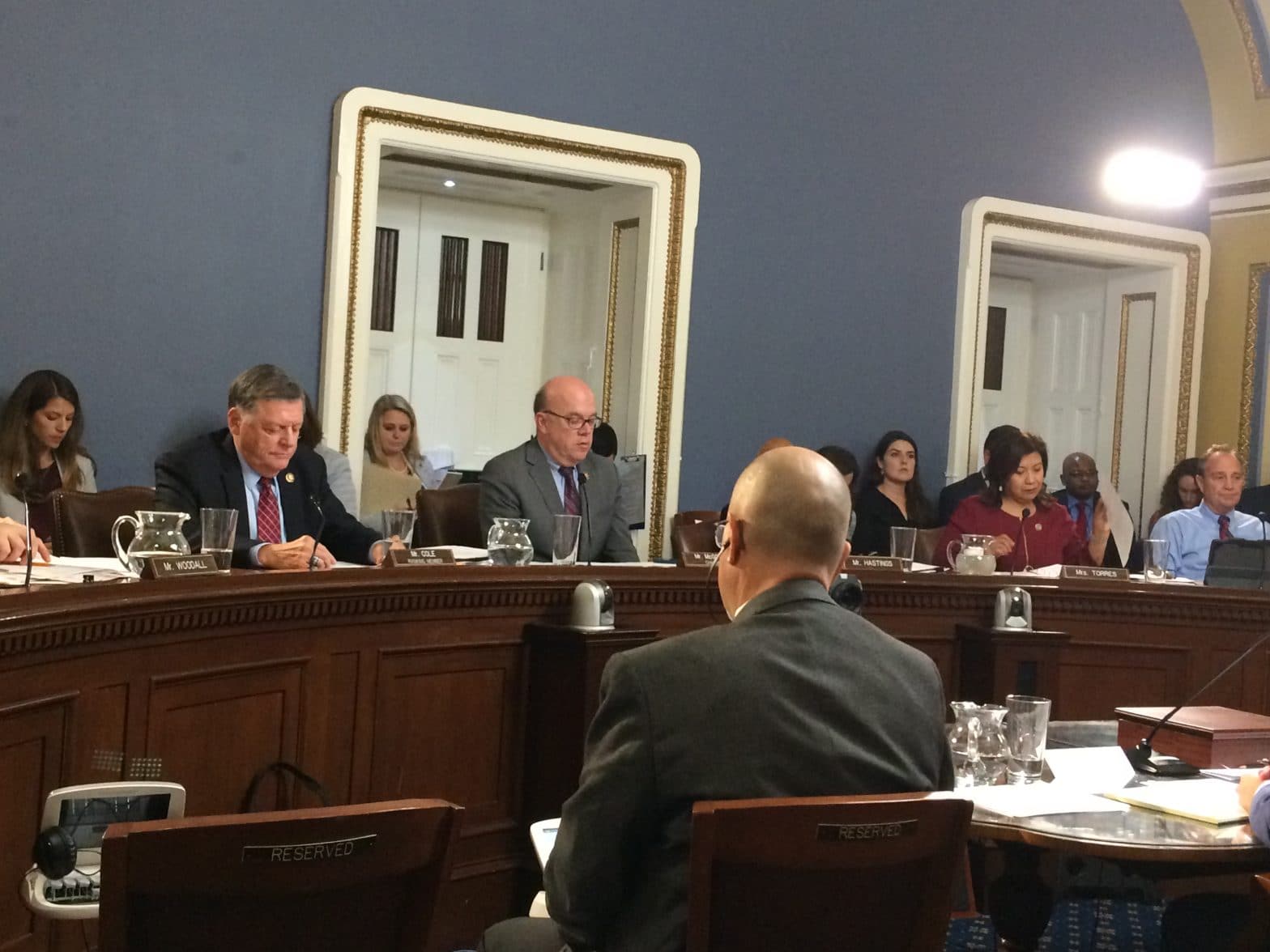

WASHINGTON — A congressional committee took a last look at a Democratic proposal to repeal a cap on state and local taxes before a vote expected in the U.S. House this week.

The cap is a $10,000 limit on state and local income tax deductions Republicans inserted into the 2017 tax reform legislation, saying it would prevent taxpayers who itemize from subsidizing higher state taxes.

Republicans also said repealing the state and local tax (SALT) deduction would unfairly benefit the wealthiest taxpayers.

“Fifty-one percent of the benefit would go to people who earn over a million dollars,” said Rep. Tom Rice, a South Carolina Republican, during a hearing Monday of the House Rules Committee.

Proof the 2017 tax reform legislation was worthwhile can be found in the booming stock market and low unemployment rates in the past two years, according to Rice.

Tampering with the tax code by repealing the SALT tax cap could interfere with recent economic gains, he said.

He warned increasing state and local tax deductions would shift more of the burden to pay for public benefits to the federal government.

“The effect of it is that the federal government subsidizes high tax jurisdictions,” Rice said.

The Democratic bill would increase the cap on state and local tax deductions to $20,000 for married couples for 2019 and repeal the cap for 2020 and 2021.

Rep. Tom Cole, an Oklahoma Republican, said the Democratic proposal would be “a big giveaway to very wealthy people.”

Other provisions in the Democratic repeal bill would increase the deduction for educators’ expenses and allow first responders to deduct job-related costs. The top individual tax rate would increase from 37 percent to 39.6 percent for 2020 through 2025.

Democrats who spoke during the House Rules Committee hearing said the $10,000 cap impedes state governments’ ability to provide public services. The biggest complaints come from high tax states like California, New Jersey and New York.

The Democrats expressed concern the highest-earning residents would move to lower tax states if the $10,000 cap is not eliminated.

“For me, it’s about fairness,” said Rep. Brad Schneider, an Illinois Democrat. “That burden is going to fall on working families.”

The current cap “is quite simply double taxation, and it is wrong,” Schneider said.

Raising the cap under the pending bill would generate $2.4 billion in deficit reduction, he said.

“It pays for itself,” Schneider said.