Administration Extends Student Loan Payment Pause Through June

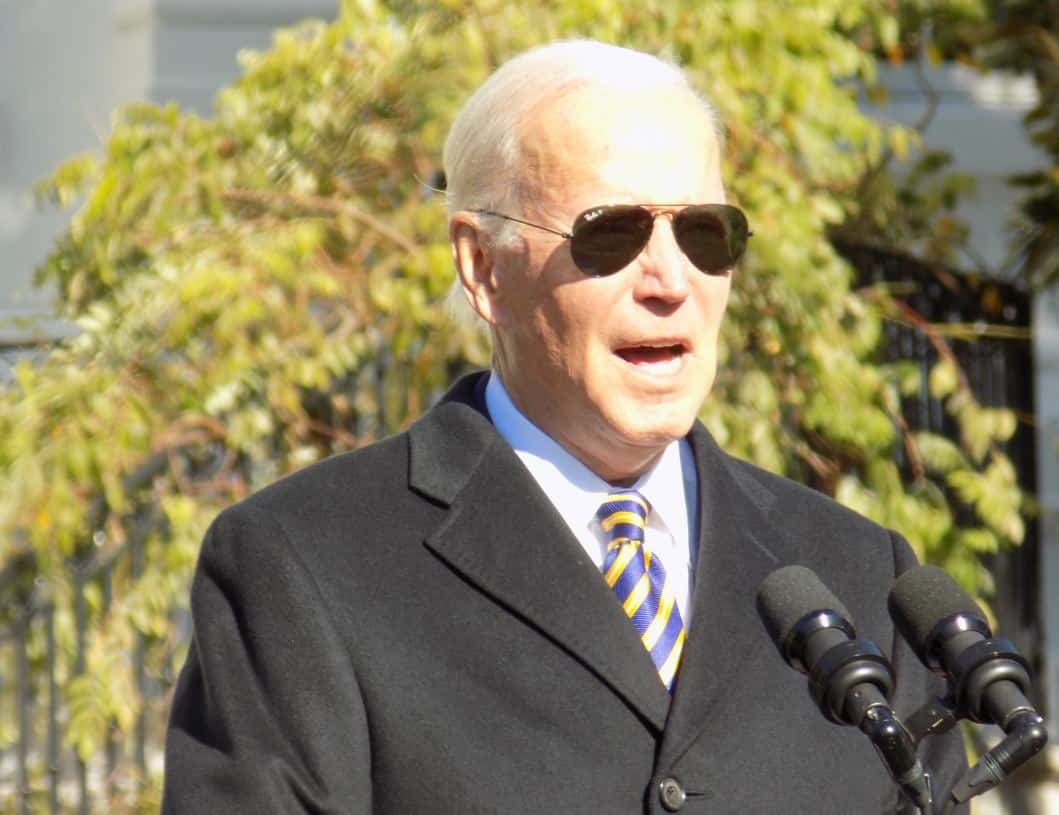

WASHINGTON — The Biden administration on Tuesday afternoon extended its pause of federal student loan repayments to June 30, 2023, saying the move was necessary to give the U.S. Supreme Court time to rule in a case challenging the program.

“I’m confident that our student debt relief plan is legal. But it’s on hold because Republican officials want to block it,” said President Joe Biden in a tweet as the decision was made public.

Loan payments were first put on hold in March 2020 under former President Trump as part of the federal government’s response to the coronavirus pandemic, and the pause in repayments has since been extended six times, most recently in August.

At that time, the pause was set to expire on Dec. 31, to be supplanted by then newly announced student loan forgiveness program.

On Aug. 24, Biden and Education Secretary Miguel Cardona announced plans to provide targeted student debt relief to borrowers with loans held by the Department of Education.

Borrowers with annual income during the pandemic of under $125,000 (for individuals) or under $250,000 (for married couples or heads of households) who received a Pell Grant in college would be eligible for up to $20,000 in debt cancellation.

At the time administration officials said the August extension on the loan repayment pause would be the last.

But in a reversal, the Education Department extended the pause on student loan repayments, interest, and collections a full six months, explaining that it would “alleviate uncertainty for borrowers” while the administration pressed its case before the justices.

The administration has asked the Supreme Court to review the lower-court orders that are preventing the Education Department from providing debt relief for an estimated tens of millions of Americans.

“Callous efforts to block student debt relief in the courts have caused tremendous financial uncertainty for millions of borrowers who cannot set their family budgets or even plan for the holidays without a clear picture of their student debt obligations, and it’s just plain wrong,” said Cardona in a written statement.

“I want borrowers to know that the administration has their backs and we’re as committed as ever to fighting to deliver essential student debt relief to tens of millions of Americans,” he said.

“We’re extending the payment pause because it would be deeply unfair to ask borrowers to pay a debt that they wouldn’t have to pay, were it not for the baseless lawsuits brought by Republican officials and special interests.”

Payments will resume 60 days after the department is permitted to implement the program or the litigation is resolved.

If the program has not been implemented and the litigation has not been resolved by June 30, 2023 — payments will resume 60 days after that, the department said.

To date, over 26 million people have provided the necessary information to be considered for debt relief, and 16 million borrowers have been approved, the Education Department said.

Last week, the Department of Justice requested that the Supreme Court lift the lower court’s injunction against the program and suggested that if the court does not do so, it could take up the student debt relief case, to provide borrowers the clarity and relief they are depending on.

Borrowers can use the additional time to ensure their contact information is up to date with their loan servicers and consider enrolling in electronic debit and income-driven repayment plans to support a smooth transition to repayment.

Dan can be reached at [email protected] and at https://twitter.com/DanMcCue