White House Agrees to Bipartisan Talks on Interim ‘Paycheck Protection’ Bill

WASHINGTON — The Trump administration agreed on Friday to pursue bipartisan talks with members of the House and Senate on an interim bill to boost funding to the federal government’s $350 million “Paycheck Protection” program.

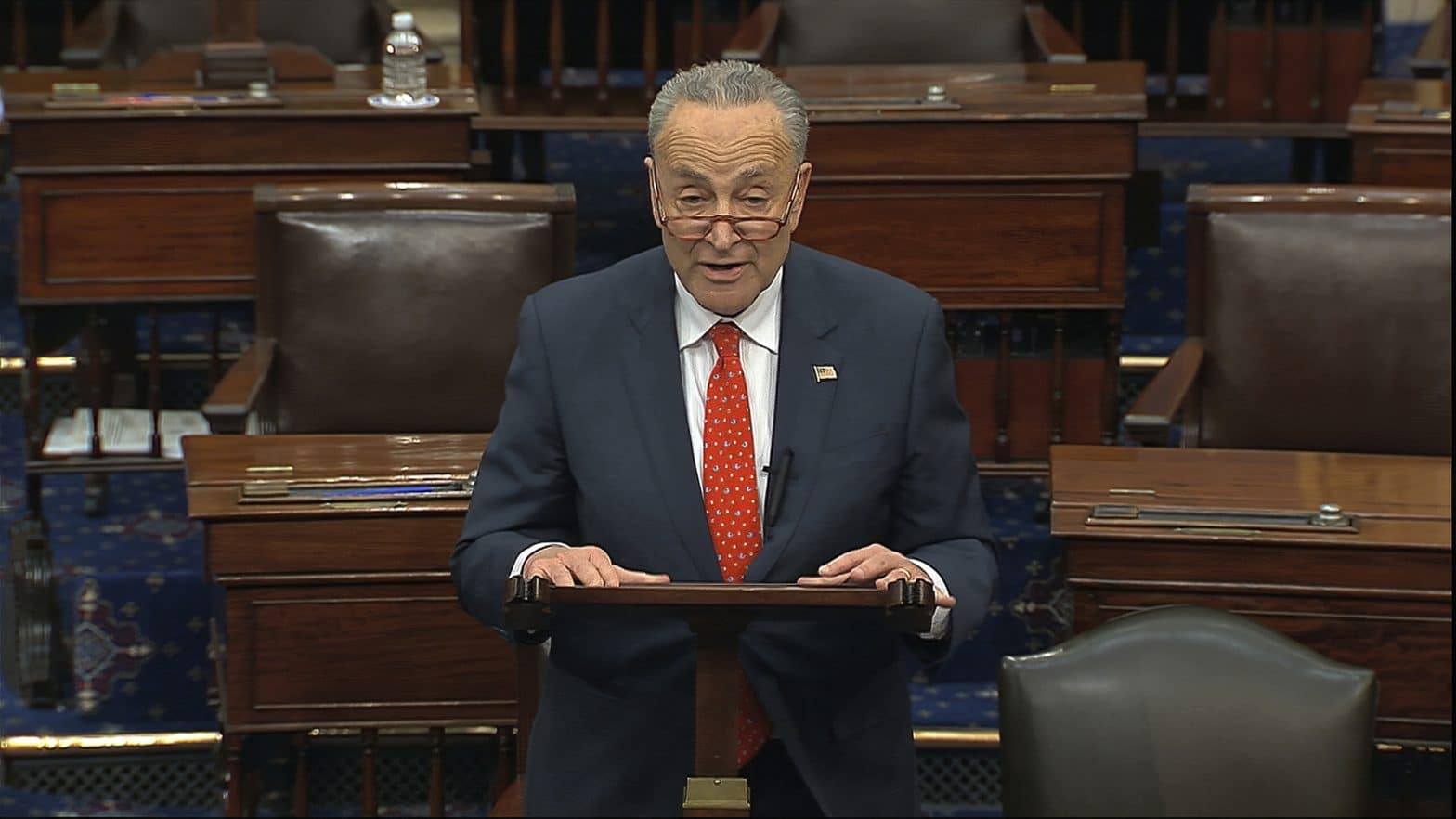

Senate Minority Leader Chuck Schumer said Friday afternoon that he had spoken with Treasury Secretary Steven Mnuchin and that he came away from the conversation hopeful that a deal could be struck sometime early next week.

Schumer’s comments come a day after Democrats blocked an attempt by Senate Majority Leader Mitch McConnell, R-Ky., to pass a $250 billion infusion into the business program by a voice vote.

Sen. Ben Cardin, D-Md., ranking member on the Senate Small Business Committee, said he stopped the Republican effort in its tracks because it wouldn’t go far enough to address the immediate needs of small businesses.

The proposal he said, “leaves out where small businesses need help today. “

The $349 billion “Paycheck Protection” program is the first part of the $2.3 trillion coronavirus economic rescue package to get up and running.

It relies on an existing SBA guaranty program to give small businesses forgivable loans to cover up to eight weeks of payroll and other fixed costs. If the companies mostly use the money to pay their workers during the pandemic’s economic shutdown, then they won’t have to pay it back.

Congress is in an unprecedented situation in which convening either chamber to do business requiring roll call votes is out of the question as the nation is locked down by the coronavirus pandemic. That means legislation has to advance by consensus only.

Democrats say they want safeguards to ensure that funding under the program can reach all eligible businesses, including those that do not have established credit relationships with banks such as minority-owned firms.

Schumer himself has said he is pressing to add funding for health care providers such as hospitals, as well as further funding for cash-poor state and local governments.