Watchdog Warns Biden COVID Relief Plan Comes with Potential Risks

The new administration’s $1.9 trillion relief plan could potentially lead to longer-term risks of increased public debt, higher inflation, overvaluing of products, an economic crash and dependence on future stimulus funding, according to the Committee for a Responsible Federal Budget.

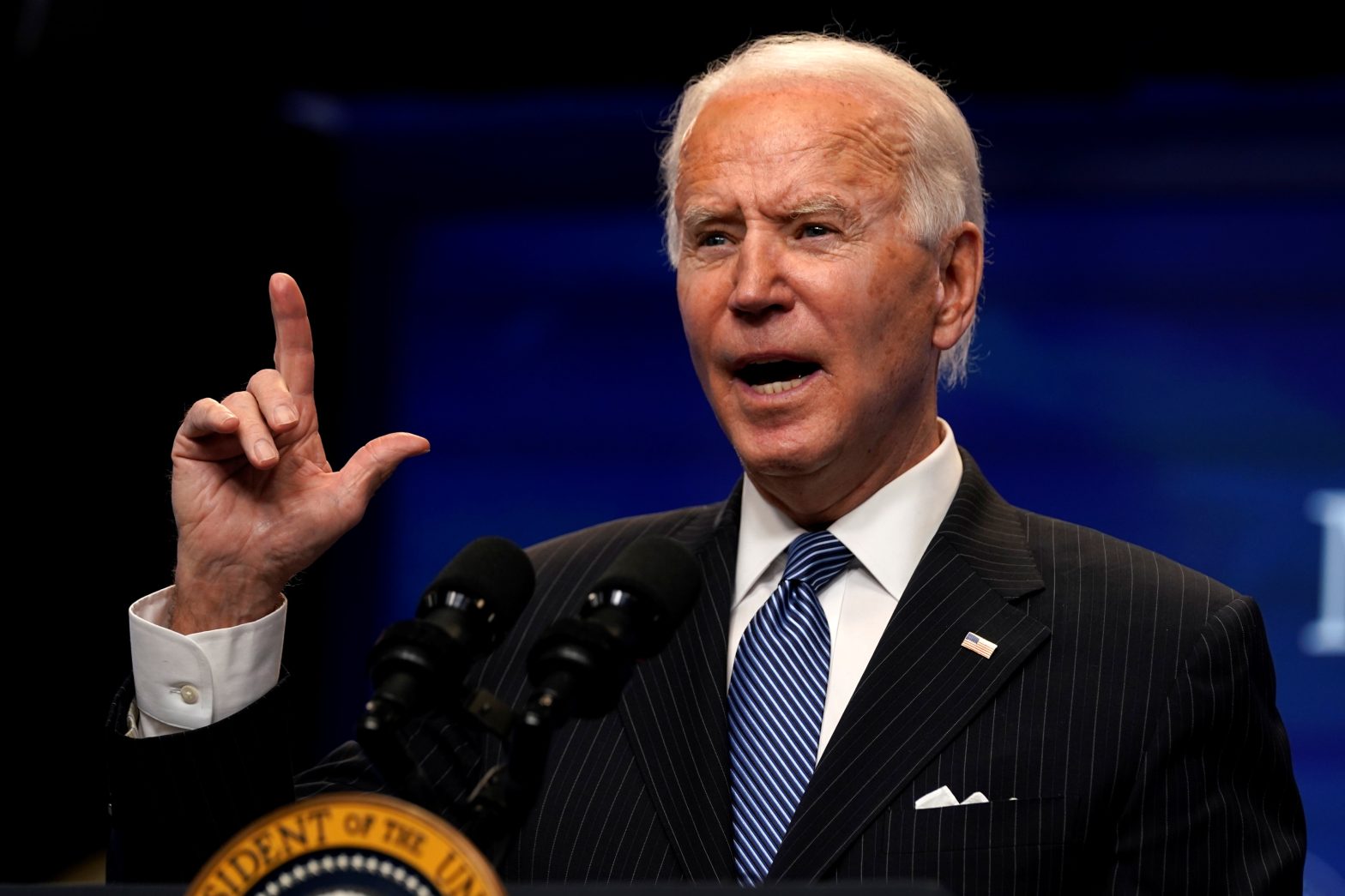

Given the economic recession caused by the COVID pandemic, experts are scrambling to grasp the potential outcomes of when, how and at what pace the U.S. economy will recover. This week, the non-profit nonpartisan organization tasked with informing the public of fiscal policy developments stated that excess funding from President Joe Biden’s American Rescue Plan would “overshoot” closing what is known as the economic “output gap” – the difference between the country’s actual Gross Domestic Product and the potential GDP if it were operating in a normal economy.

“Overshooting” the gap by injecting too many funds could actually leave the country worse off in the long run, warned the CRFB in a blog entitled, “How Much Would the American Rescue Plan Overshoot the Output Gap?”

“While the economy can operate above its long-term potential for periods of time, it cannot do so indefinitely or sustainably,” the CRFB wrote, basing its risk evaluation on a recently released Congressional Budget Office report.

The CBO report estimates that the gap could be $380 billion for 2021 and $700 billion by the end of 2023. What this means is that Biden’s trillion-dollar-plan would “fill” this gap more than a couple of times, according to the Committee. Citing a Brookings Institution analysis, the Committee stated the plan has the potential to increase this output by $1.5 trillion in the second quarter of 2021 closing the gap by 225% at the end of 2023.

Describing it as a “worthwhile consequence” of tackling the current economic crisis, the Committee concedes that increasing the public debt by almost $2 trillion would help mitigate the recession but could lead to lower economic multipliers – that is the dollar produced by dollar spent – than expected, therefore “adding to the debt without improving the economy.”

As an example, pointing back to the Brookings analysis, the CRFB noted that the $2 trillion would “shrink” the country’s economy by about $100 billion by the end of the decade while increasing the government’s total amount of paid interest and principal on the debt – known as debt service payments – by an estimated annual $40 billion. These debt service payments would likely increase on a yearly basis.

Despite potential benefits from higher inflation, such as eroding household and business debt and lowering Federal Reserve’s interest rates, the risks countering those benefits are just as big. Higher inflation could lead to rendering the stimulus relief inefficient, diminished value in savings, an increased cost of living – particularly for those who cannot actually bear the cost with their actual household income, and also set a “persistently high inflation” that pushes the rate upwardly away from a regular, durable state for long periods of time. The latter could also in turn lead to altered economic decisions – be it by the government and its policymakers or employers and players in the financial marketplace.

The third risk the Committee warned of could present itself by these “excess funds” is the “misallocation” of the value placed on goods during a time of increased consumption. In other words, higher retail prices from the increased demand. The Committee warned of the risk of “modest macroeconomic damage” on individual long-term investments.

Pointing back to the Brookings’ analysis, which showed a scenario of no economic growth in 2022, the Committee expressed its concern of this overfill pushing the economy off a “cliff,” by increasing economic activity beyond its capacity, into an economic crash once the stimulus funding “runs out.” This would lead to the last risk listed in which an economy could “become dependent on ever rising deficits” as more stimulus packages get enacted to avoid the crash and “maintain sufficient demand.” This risks even higher debt, higher interest payments and could hinder potential GDP.

Nevertheless, the uncertainty of our economy goes hand-in-hand with the uncertainty surrounding the pandemic. As these projections are based on estimates, this gap could either be less or more than CBO predicts, with some experts arguing that this year’s economic growth will be quicker and others stating the CBO is “underestimating full employment and potential GDP.”

Overfilling the gap could also mitigate the risks from missed expectations, the Committee stated. The U.S. could have lower economic multipliers than those estimated, worse economic conditions than imagined, or a higher GDP than projected. All would widen the gap and present future problems to deal with, but the fiscal funding would help cushion any future blows. It could also prevent further business closures and unemployment “hysteresis” – which is when a worker, who has been unemployed for a long period of time, drops out of the workforce whether by the loss of job skills lessening the likelihood of employment or a mere disinterest in returning after becoming accustomed to their current standard of living.