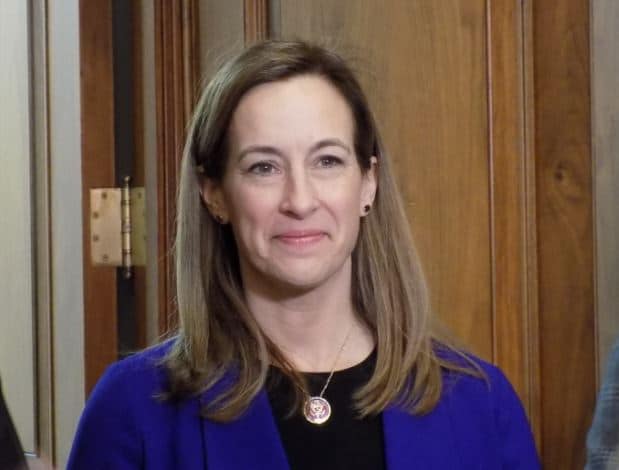

Sherrill Fights for Local Families by Rolling Back Tax Deduction Caps

WASHINGTON – Rep. Mikie Sherrill, D-N.J., knew it would be a crippling blow to her constituents and the local economy.

It had been bad enough when the Republican Tax Cut and Jobs Act enacted in 2017 capped the deduction middle class taxpayers would take for their state and local taxes at $10,000.

Now — in the summer of 2019 — the U.S. Treasury Dept. was barring municipalities from creating solutions to help people adversely affected by the cap and preserve the pool of disposable income they depended on to survive.

Since 1913, taxpayers choosing to itemize could deduct state and local taxes from their federal returns. But the Jobs Act and the Treasury rule were effectively stomping on 150 years of precedent in federal tax law, disproportionately harming residents of states like New Jersey, and unfairly imposing a marriage penalty on couples filing jointly.

“The state and local tax deduction cap … placed a significant burden on residents in my community,” Sherrill said.

Quickly, she and fellow New Jerseyite, Rep. Josh Gottheimer, marshaled their resources and introduced the bipartisan H.J. Res. 72 to overturn harmful regulations.

Specifically they were relying on the Congressional Review Act of 1996, which established procedures by which the House and Senate may strike down regulations issued by federal agencies.

Under the Act, members of Congress can introduce resolutions of disapproval within 60 days of receiving a proposed regulation.

If the disapproval resolution is passed by both chambers, the rule cannot take effect and the agency is barred from issuing a substantially similar rule without subsequent statutory authorization.

To Sherrill, full-throated opposition was all that made sense.

“The U.S. Treasury Department’s wrongheaded decision … was done without congressional input and our resolution will give power back to states like New Jersey to address the high cost of living — only made worse by the loss of the full SALT deduction in 2017,” the congresswoman added.

The road ahead would not be easy.

Though Sherrill was gaining support on the issue through her work on the House SALT Task Force and through her authoring the SALT Relief and Marriage Penalty Elimination Act of 2019 — a bill intended to end the marriage penalty and make the SALT deduction equal to the standard deduction taken by taxpayers — resistance to her efforts was strong.

In October 2019, the U.S. Senate rejected a companion resolution of disapproval introduced by Senate Minority Leader Charles Schumer, D-N.Y.

“The federal cap on the SALT deduction is an attack on tens of thousands of New Jersey families and taxpayers in my district. It was wrong from day one,” the representative said in response.

“That’s why New Jersey passed a state law to ease the tax burden caused by the federal SALT deduction cap. Instead of reversing course, Secretary Mnuchin and the IRS adopted a rule to block New Jersey and New York and the other states with similar laws.

“Let’s be clear,” she added, “Secretary Mnuchin and the IRS are blocking duly-passed state laws in order to target and double-tax tens of thousands of North Jersey residents. This rule is an assault on state legislatures, particularly in states like New Jersey and New York that pay far more in federal taxes than they receive.”

Unbowed, but with time running out to lift the federal cap on state and local tax deduction before the end of the year, Sherrill launched a “12 Days of SALT” campaign on the House Floor in early December.

“I rise today on behalf of the taxpayers of North Jersey,” Sherrill said on the floor of the House, at a time when most eyes were transfixed by the House impeachment hearings.

“There are 12 days left in the legislative calendar. I urge the House to close 2019 by lifting the cap on the state and local tax deduction,” she said, promising, “I will be here on the floor every day this holiday season, highlighting the impact of SALT on my constituents and on Americans across the country.’”

After Sherrill launched her campaign, colleagues from across the country joined her effort to highlight the nationwide impact of SALT.

Five days later, they passed the bipartisan Restoring Tax Fairness for States and Localities Act (H.R. 5377), removing the marriage penalty for joint filers and restoring the ability for taxpayers to deduct their state and local taxes from federal tax returns after 2020.

The vote was 218-206. The bill has since been sent to the U.S. Senate, where it has been read twice by the Finance Committee.

“Residents in every corner of the district have shared with me how badly the SALT deduction cap hit them when tax season came around. Families were forced to dip into their retirement accounts, put off home repairs, and worry about how they would pay their bills,” Sherrill said. “I will continue to work to get this passed through the Senate and so we can put money back in the pockets of New Jersey families and support our teachers and first responders across the country.”