New Bill Seeks to Make Bankruptcy Easier For Consumers Hit by Pandemic Recession

WASHINGTON — Democratic members of Congress are trying to throw a lifeline to families and individuals teetering toward financial disaster during the COVID-19 pandemic with a new bill designed to make claiming bankruptcy easier.

The Consumer Bankruptcy Reform Act introduced this week would lower the cost of bankruptcy protection and streamline the process. Primary goals are to prevent home foreclosures and relieve student loan debt.

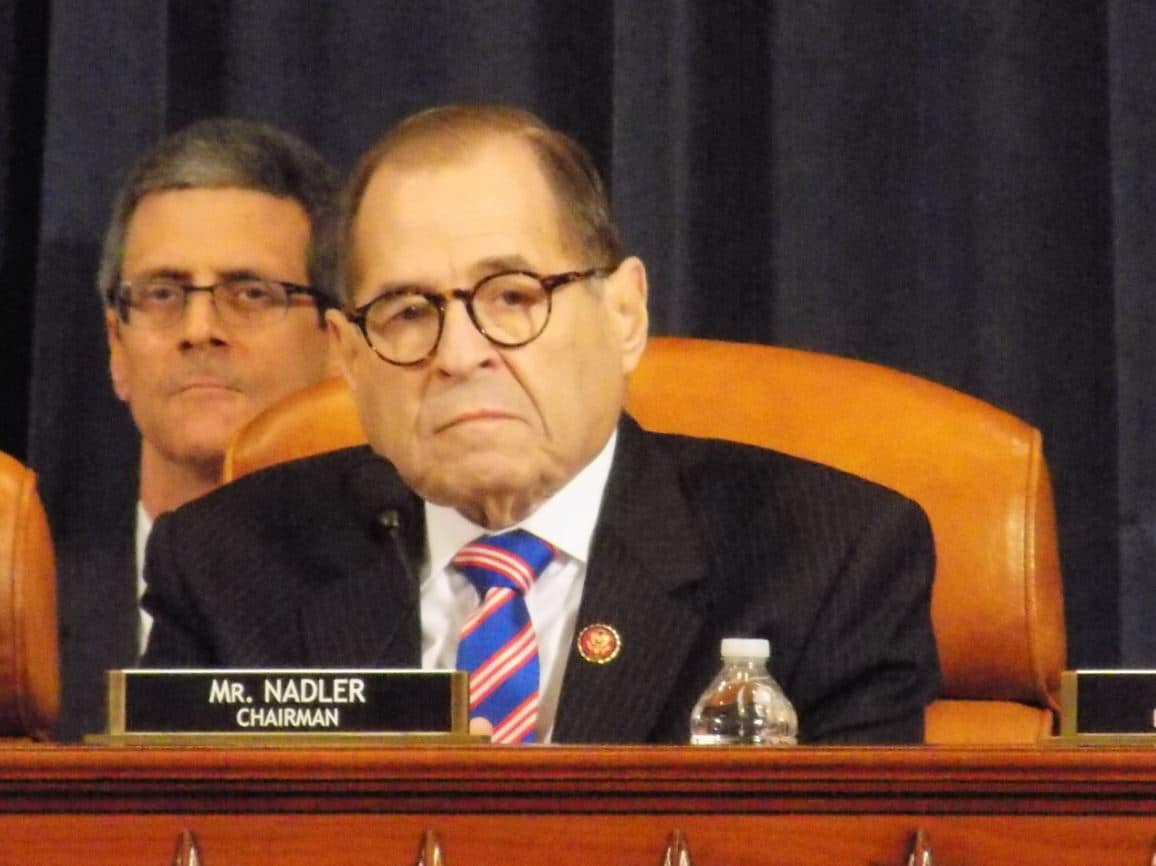

U.S. Rep. Jerrold Nadler, D-N.Y., who co-sponsored the bill, said the reforms are needed because the cost and complexities of the bankruptcy system make it inaccessible to some consumers who are being driven toward homelessness.

“Bankruptcy is an option of last resort, but it also promises a fresh start so that people can get back up and keep working and providing for their families,” Nadler said. “Today that promise rings hollow for many people because the bankruptcy system has become complex, unfair and even punitive for ordinary consumers.”

Bankruptcy helps people or organizations unable to repay debts seek relief with court oversight. Typically, the courts will allow debt restructuring in which debts can be reduced or renegotiated, often including putting a stop to home foreclosures or evictions.

Some Republicans caution that making bankruptcies easier could result in higher interest rates on loans, thereby extending the time needed for the nation to recover from the pandemic-induced recession.

Introduction of the bill coincides with warnings from economists of what could be a record wave of bankruptcies next year.

“The unique features of the COVID-19 recession raise questions about what we should expect to see in the bankruptcy courts,” a recent Harvard Business School “working paper” says. “The sheer magnitude of the economic shock suggests the potential for significant financial distress for both consumers and businesses.”

Among the more than 20 million people who filed for unemployment in April, many are close to having their benefits expire. Other aid from the federal Payroll Protection Program and the Coronavirus Aid, Relief, and Economic Security Act are running out.

A U.S. Census Bureau report shows more than half of households suffered income loss between March 13th and July 21st. About 74% of small businesses lost money between April 26th and May 2nd.

The Harvard economists say bankruptcy courts could be overwhelmed by consumers seeking debt relief unless Congress acts promptly to help them.

The Administrative Office of U.S. Courts is asking Congress for a $36 million supplement to fund 14 permanent bankruptcy judgeships and to extend filing deadlines. “The economic impact of the COVID-19 pandemic in some respects exceeds that of the 2008 Great Recession,” says the agency’s letter to congressional leaders.

Maryland Gov. Larry Hogan stressed the need for further federal assistance at a press conference Thursday when he described the desperate financial status of many households.

“They’re at the end of their rope,” Hogan said. “We desperately need the federal help.”

He added, “It has to be right now.”

President-elect Joe Biden has signaled his support for the Consumer Bankruptcy Reform Act as an additional federal relief effort.

While he was a senator in 2005, he said he supported bankruptcy reforms similar to the bill proposed in Congress this week.

The Consumer Bankruptcy Reform Act would create a new consumer bankruptcy option, called chapter 10. It would replace the more all-encompassing chapter 7 liquidation and the more complex chapter 11 restructuring.

Other provisions would allow municipal fines and student debt to be discharged completely. Consumers also would gain broader rights to sue aggressive debt collectors who violate regulations of their profession.

Further support for the bill is coming from the Washington-based National Association of Consumer Bankruptcy Attorneys.

NACBA President John Colwell said that “now is the time to make the improvements to the Bankruptcy Code that have long been needed.”