House Votes To Block Controversial Rewrite Of Decades-Old Anti-Redlining Laws

WASHINGTON — The House on Monday voted to block the Trump administration from overhauling rules that affect how banks make loans to people in lower to moderate-income communities.

The resolution, introduced by Rep. Maxine Waters, challenges a recent ruling by the Office of the Comptroller of the Currency that amends the Community Reinvestment Act. It will now head to the Senate, where Republicans are expected to block the measure.

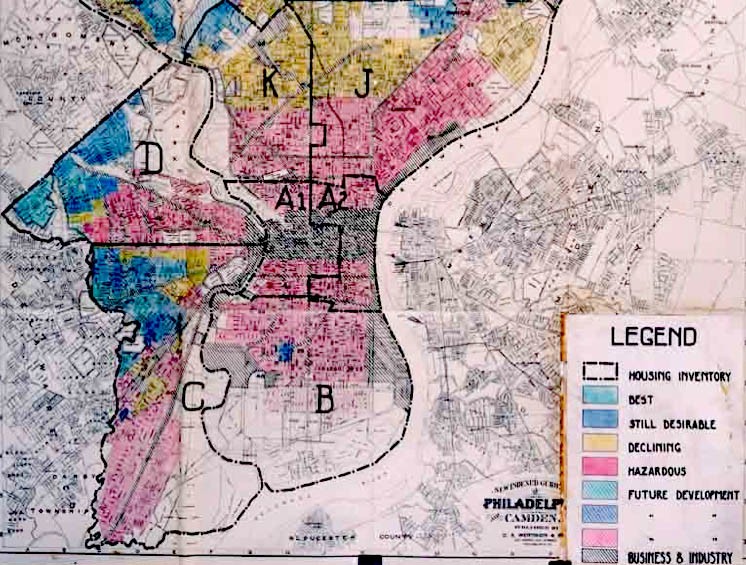

Congress passed the CRA in 1977 to reverse the effects of widespread redlining, a discriminatory practice by which banks avoided lending money to mostly-minority communities in lower-income neighborhoods.

But last month, then-OCC Commissioner Joseph Otting announced a long-expected overhaul of the rule without support from other banking regulators, just one day before abruptly stepping down.

Otting’s resignation was condemned on Monday by Waters, who accused the former banking CEO of steamrolling through changes that would benefit the banking industry while hurting consumers.

“Despite the warnings of a wide range of stakeholders, former Comptroller Joseph Otting rushed to finalize this rule in his final days on the job,” Waters said on Monday.

“Mr. Otting appears to have been determined to undermine the Community Reinvestment Act ever since the law complicated his efforts to quickly obtain regulatory approval for OneWest Bank, a bank he ran with Treasury Secretary Mnuchin, to merge with another bank in 2015.”

At the core of the OCC rule is a change to performance metrics used by federal regulators to grade banks on their ability to provide financial services to lower-income communities.

Every two to five years, banks receive a CRA “rating” that is calculated based on a set of factors that varies depending on an institution’s size and mission. The grades, which are posted publicly, are meant to encourage banks to meet the borrowing needs of people in underserved communities.

Critics of the OCC rule say it waters down the CRA by pushing banks to pursue large financial deals with corporations instead of incentivizing smaller loans that benefit individuals in lower-income communities.

“I am deeply concerned that the OCC’s final rule will harm low-income and minority communities that are disproportionately suffering during this crisis, effectively turning the Community Reinvestment Act into the Community Disinvestment Act,” said Waters, who chairs the House’s Committee On Financial Services.

Last week, advocates filed a federal lawsuit against the Trump administration and OCC Acting Comptroller Brian Brooks in response to the OCC ruling. The complaint, filed on June 25 by the National Community Reinvestment Coalition and the California Reinvestment Coalition, alleges that OCC violated federal laws by hastily issuing a final rule that “eviscerates” the CRA without community input.

“The new rules weaken requirements for banks to lend to lower-income borrowers and communities, which is the whole point of the law,” said Jesse Van Tol, CEO of NCRC, in a statement. “To make matters worse, it is clear that the OCC ignored the vast majority of community organizations’ dissenting comments. Even most banks don’t want these new rules put into place, and they still are unsure what it will take to implement them.”

The OCC billed the final rule as a move to “strengthen and modernize” the CRA, but the Federal Deposit Insurance Corporation, one of two federal agencies that insure bank loans, declined to back the changes.

“While the FDIC strongly supports the efforts to make the CRA rules clearer, more transparent, and less subjective, the agency is not prepared to finalize the CRA proposal at this time,” said FDIC Chairman Jelena McWilliams in a statement on May 20.

Banking industry groups like the American Bankers Association have long advocated for a modernization of the CRA, arguing that the decades-old regulations are no longer relevant in the era of digital banking.

“Stakeholders on all sides have acknowledged that the current CRA regime has failed to keep pace with the evolution of banking and community needs,” said ABA President Rob Nichols in a statement in May. “We appreciate that today’s final rule identifies a list of activities that qualify for CRA credit that will be effective immediately. Banks and the communities they serve will benefit from this certainty.”

Nichols expressed concern, however, that the rule was not backed by other federal regulators, and said that the proposed performance metrics “present significant data collection challenges for banks.”

Research shows that decades of redlining in U.S. cities have led to widespread economic blight that is still being felt by minority communities in metropolitan areas today.

According to a 2018 report by the Brookings Institution, “majority black neighborhoods suffer from lower quality housing and limited access to good schools and neighborhood amenities.”

The study, which examined the legacy of redlining and other exclusionary housing policies, found that homes in neighborhoods where 50% of the population is Black are today worth roughly half the price of homes in neighborhoods with no Black residents.

On average, homes in majority-black neighborhoods are undervalued by $48,000, which amounts to $156 billion in cumulative losses across the country, the report found.