Could the U.S. Be Close to Creating a Digital Dollar?

WASHINGTON — While cryptocurrencies have dominated the news, another type of digital currency is being considered by the central banks of dozens of countries including the United States. Starkly different from crypto, these electronic currencies would have the full backing of their national governments, but opponents remain apprehensive about their design and implementation, with particular concerns about privacy.

“But for the development of bitcoin, we would not be having this conversation right now,” Daniel Gorfine, co-founder of the Digital Dollar Project told an online audience of the National Press Foundation convened to consider the implications of the U.S. creating a national digital currency. This is because the popularity and increasing pervasiveness of crypto paved the way for central banks to consider digitizing national currencies.

China was among the first to create a digital yuan; there may be a digital euro by the middle of the decade, and the bank of Japan kicked off a pilot project. But the U.S. is still studying the issue. Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen admitted that a digital dollar is being researched, launching a project with M.I.T. to evaluate its efficacy, though they cannot act further without specific Congressional authority.

“This doesn’t mean that cash is going away,” said Gorfine. Instead, he believes the momentum building around a digital dollar could be “complementary to and sometimes used as an alternative to” cash.

A digital dollar is different from bitcoin or dogecoin, but it’s also different from the non-tangible dollars Americans may have saved in their bank accounts.

Decentralized and unregulated cryptocurrencies like bitcoin, ethereum, and the like are not issued by a central authority, are not pegged to another asset, use distributed ledger technology like blockchain, and have a value that comes mainly from scarcity. As a result, these currencies experience strong volatility.

National central banks are considering creating digital currencies to take advantage of many of the same benefits that led to the creation of crypto, like reducing intermediaries to automate transactions, but a digital dollar, for example, would be issued by the U.S. Treasury and backed by the full faith and credit of the United States government.

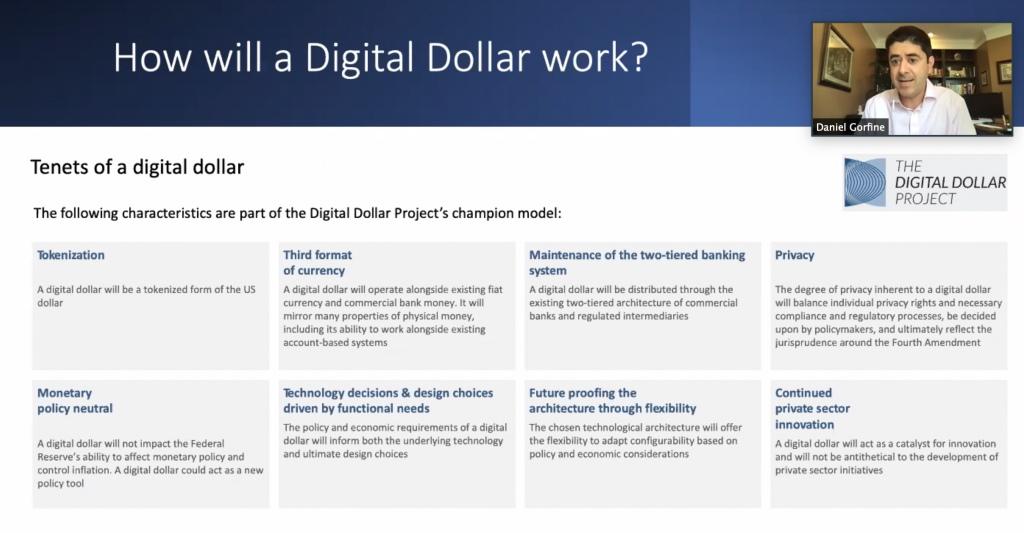

Depending on the design of the U.S. digital currency, digital dollars could come from and be stored directly in central bank accounts, or the United States could retain its two-tiered banking system and tokenize the digital dollar, meaning that it would replicate some features of cash in a digital context.

Josh Lipsky, director of the GeoEconomic Center at the Atlantic Council and a digital currency tracker said that digital currencies are an “interesting, important, and I think often misunderstood topic.” While he believes the U.S. government is exploring the creation of a digital dollar to make transactions faster, cheaper, and safer, and it has the potential to give unbanked people access to the financial system, Lipsky also recognized that there are concerns surrounding the design of a digital dollar and its implementation.

“The promise is… instant viable secure transactions,” said Lipsky, citing, for example, the ability of American citizens to receive economic recovery monies or other government assistance program funds immediately. Yet existing implementation from nations like China has created anxiety around real-time surveillance of citizens as well as programmatic and civil liberty concerns.

“[Users may] trade some anonymity for the convenience of use,” said Lipsky. But he suggested that, depending on a digital currency’s design, some unseemly repercussions could result. For example, if the currency were designed to be programmable, payers might be able to set expiration dates for use. Or authoritarian governments could put limitations on funds or deny payments to companies or brands to which they were hostile.

But not all design factors are potentially nefarious. They are also important, explained Adrienne Harris, professor of Practice at the University of Michigan and former special assistant to President Obama for financial services, so that those traditionally excluded from the financial system can benefit and feel comfortable adopting a digital currency option.

“[The digital dollar] can be designed to maintain privacy… or not,” Harris said. “We would design a digital dollar with privacy in mind… so government actors would not be able to see where you’re buying things and what you’re buying.”

While most countries developing central bank currencies are doing so in token form in partnership with private banks, Harris suggested that designing a system with federal accounts might best serve those who mistrust banks or can’t afford bank fees.

“[Any] digital dollar is meant to provide choice and competition in allowing consumers to pay in different ways,” said Harris. “This could essentially serve as a public option.”

But based on his findings at the Digital Dollar Project, Gorfine favors tokenization and two-tiered distribution with commercial banks and other regulated entities acting as intermediaries between the Federal Reserve and end-users. This would preserve the current distribution architecture — likely making adoption of a digital dollar more conventional for most Americans — while still leaving room for innovation and accessibility.

Still, despite the nation’s digital currency design, Gorfine said the geopolitical implications of not moving with a “proactive forward-leaning stance” are dire. And this is not just because the Chinese are already full steam ahead.

“Leadership by the U.S…. is important in terms of setting standards and norms around digital currencies,” he said. “Assuming [that our current monetary system] is as good as it will ever be is… not a good way to win the future… The understanding is that the future of money is at stake here.”